That enormous Australian real estate bubble might finally collapse soon (or at least prices will correct downwards). Who can afford (or is willing to) a mortgage of more than 7-8 wage years?

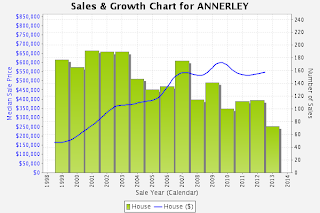

To show why, I will just take a typical suburb of Brisbane - Annerley (4103). Graph on the right shows the house price history together with number of sales (bars) (Source: www.pricefinder.com.au).

To show why, I will just take a typical suburb of Brisbane - Annerley (4103). Graph on the right shows the house price history together with number of sales (bars) (Source: www.pricefinder.com.au).As you can see, house prices are saturating, while the amount of sales is going down. So, how the house prices could be rising in the future if the demand and sales are dropping?

I find it very simple (though I might be wrong), that the climb of house prices nearly perfectly overlap with the rise of Australian mining industry.

Graph on the left shows historical Australian coal, coke and briquette quarterly exports ($A millions).

Naturally, everything, including house prices has been rising in Australia ever since the mining boom has started.

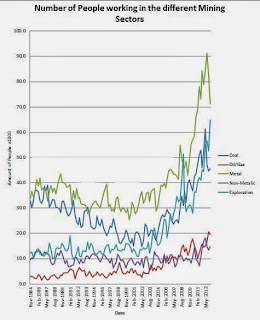

The following graph shown on the right is the historical data of the number of people working in the different mining sectors.

It seems that there is a slight delay (a year or two) between the rise of house prices and the rise of mining industry, though. But, that I bet could be explained one way or another.

So, the most interesting and important point is that now the investment into mining is slowing down. While is industry obviously will remain strong for some time, it is clear that some jobs will be cut. As the affordability of houses drops, that big bubble of real estate becomes unsustainable and prices correct to somewhat more reasonable than 7-8 wage years

Update 14.12.2014: I found an in-depth article addressing housing/real estate bubble in Australia.

Update 16.03.2015: check another interesting article describing the underlying reasons for real estate bubble in Australia.

No comments:

Post a Comment